A compensation is a one-time non-salary fee compensation for labor input. What differs a compensation from salary is that the recipient is not usually employed by the payer, and aside from possible tax, no additional employer costs are applied.

Examples of compensation:

For associations and organizations:

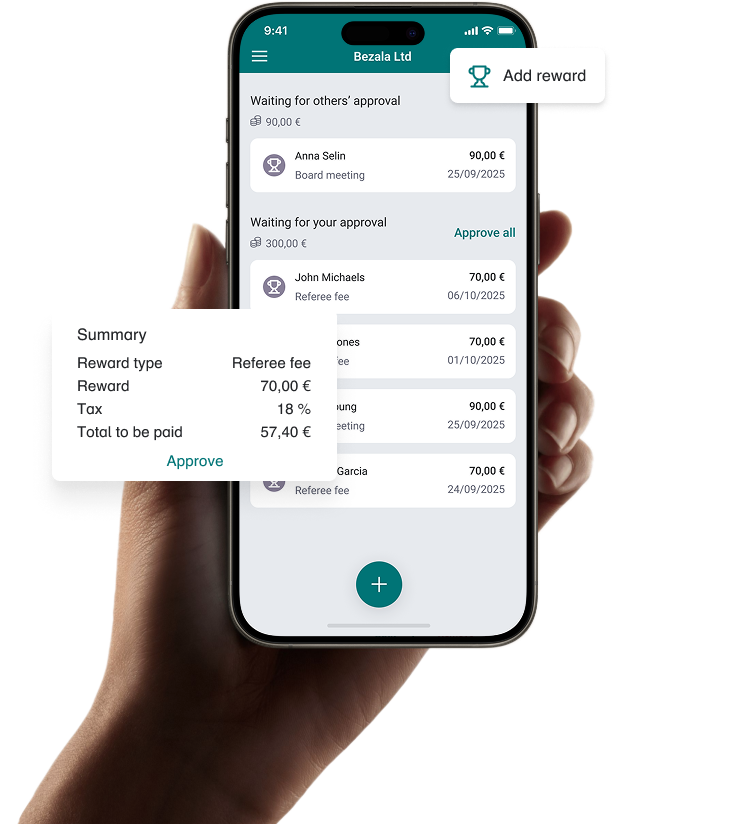

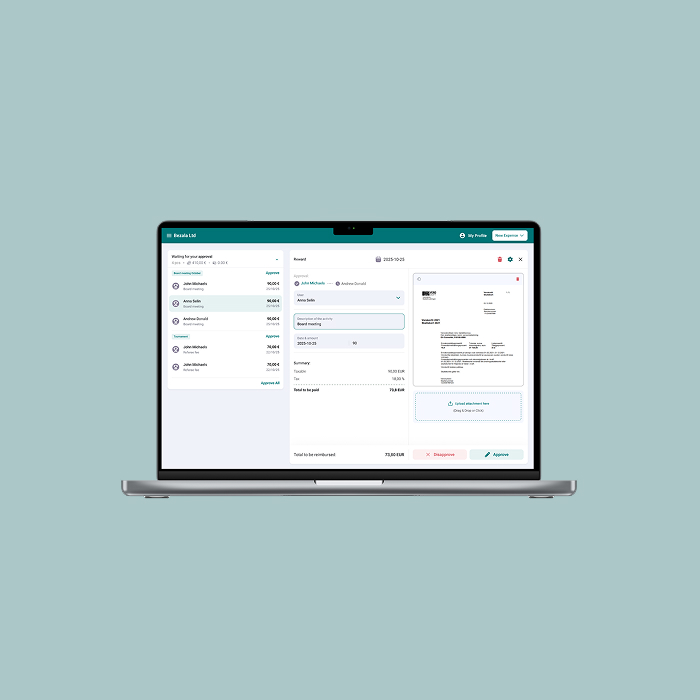

- Meeting reward for a board member

- Compensation for referees and judges

- Fees for trainers and lecturers

For companies:

- Freelance projects and expert work

- Compensation for beta testers

- Rewards for interviews and surveys

- Training and consulting projects

For media and communications:

- Reward for a guest appearance on radio and TV programs

- Compensation for interviewees

- Fees for columnists and freelance writers