Travel expenses in United Kingdom

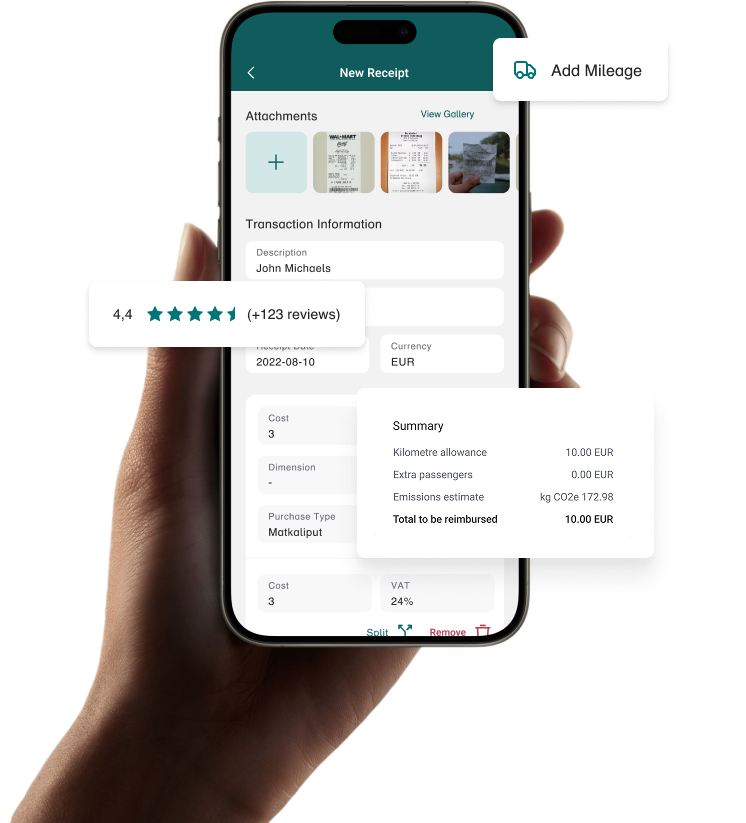

The Bezala travel expense app allows you to apply for local per diems and mileage allowances defined by the UK’s tax, payments and customs authority HMRC.

The Bezala travel expense app allows you to apply for local per diems and mileage allowances defined by the UK’s tax, payments and customs authority HMRC.

| Currency | Sterling (united pund), £ |

| VAT | 0%, 5%, 20% |

| Mileage allowance | £0.45/mile |

| Per Diem | £5-25 |

The mileage reimbursement in the United Kingdom in 2026 is 0.45£/mile.

You can apply for UK mileage reimbursements with Bezala.

In the United Kingdom, the tax-free daily allowance for employees depends on the length of the business trip:

Trips lasting 5-10 hours: £5

Trips lasting 10-15 hours: £10

Trips over 15 hours (lasting past 6 pm): £25

Unlike in many other countries, meals provided during the trip do not affect the daily allowance amount in UK.

For foreign daily allowances, the compensation for trips lasting five, ten, and 24 hours is defined on a country-by-country basis. In addition to these, a country-specific room rate may be paid for foreign trips.

Bezala has an integration to USA based ERP system Netsuite.

In additional, you can create and modify csv files and we will send them directly to an SFTP server or e-mail. Check out our integrations.

Your team can easily file Receipts, Mileages and Per Diems and you can Approve them with one click. We’ll remind your employees of missing credit card receipts and automatically take care of your accounting.

Get in touch, and we’ll discuss your organization’s needs and explore together how Bezala could help – or download a brochure to learn more at your own pace first.

Need help? Don’t hesitate to reach out—our team is here for you! Open Monday-Friday 9 am to 3 pm (Helsinki time zone).

Help center