KÄY NÄMÄ LÄPI

Travel expenses in Ukraine

The Bezala travel expense app allows you to apply for local per diems and mileage allowances defined by the French authorities.

KÄY NÄMÄ LÄPI

The Bezala travel expense app allows you to apply for local per diems and mileage allowances defined by the French authorities.

| Currency | Euro € |

| VAT | 0%, 2.1%, 5.5%, 10%, 20% |

| Mileage allowance | 0.523€/km |

| Per Diem | 42.20€ |

In France mileages are paid depending on the vehicles’ power in conjunction.

0,23€ on oikee

| 3 CV or less | 0.529€/km |

| 4 CV | 0.606€/km |

| 5 CV | 0.636€/km |

| 6 CV | 0.665€/km |

| 7 CV or more | 0.697€/km |

When an employee claims mileage for driving more than 5000 kilometers, the mileage rate decreases. To see the specific amounts for these reduced rates, please check this page.

In Netherlands companies tend to use reimbursements instead of per diems. In Bezala you can add “Day fee” expense category for these sort of reimbursements. You can also set daily limits to the category.

Bezala has an integration to USA based ERP system Netsuite.

In additional, you can create and modify csv files and we will send them directly to an SFTP server or e-mail. Check out our integrations.

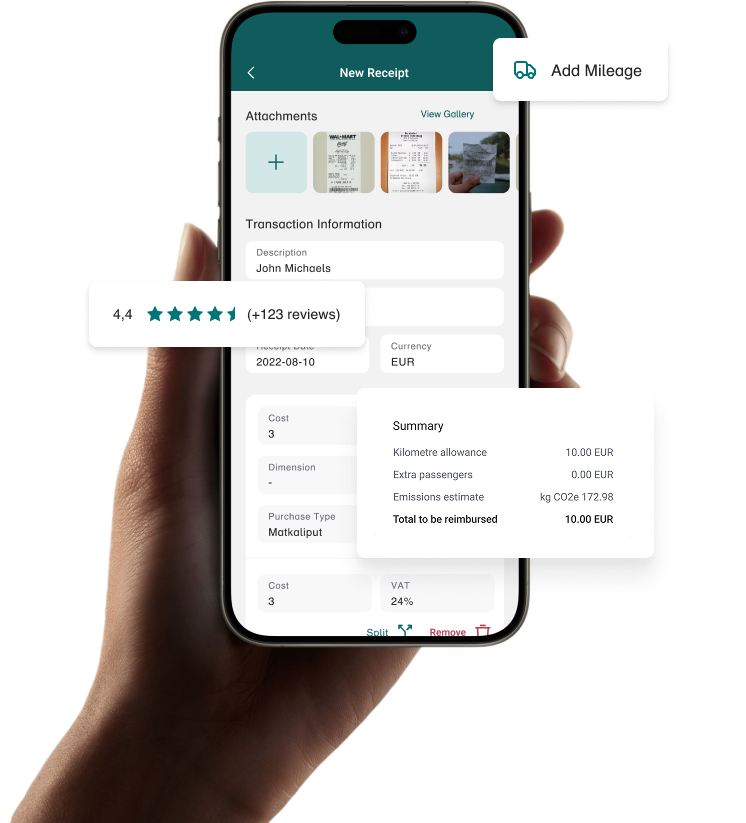

Your team can easily file Receipts, Mileages and Per Diems and you can Approve them with one click. We’ll remind your employees of missing credit card receipts and automatically take care of your accounting.

Get in touch, and we’ll discuss your organization’s needs and explore together how Bezala could help – or download a brochure to learn more at your own pace first.

Need help? Don’t hesitate to reach out—our team is here for you! Open Monday-Friday 9 am to 3 pm (Helsinki time zone).

Help center