Looking for the optimal process for company credit card receipts?

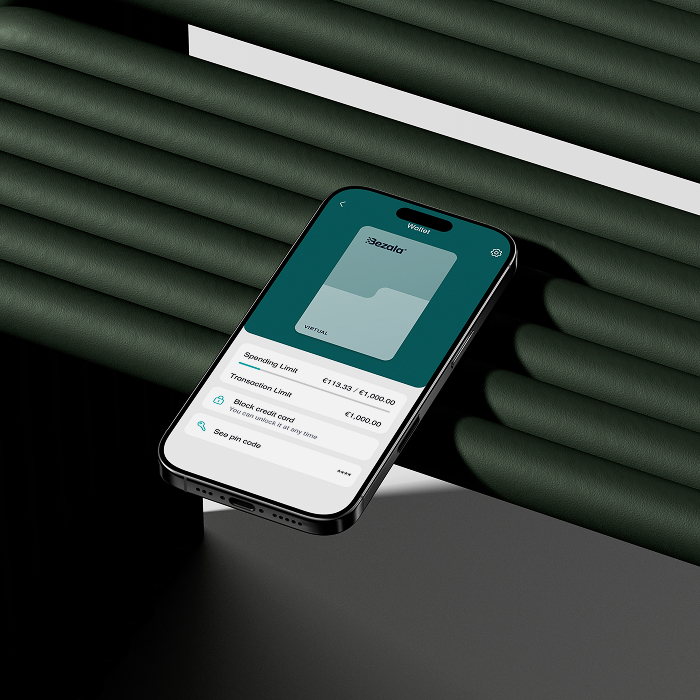

Bezala automates reminders of missing receipts and simplifies your company’s spending process.

Bezala automates reminders of missing receipts and simplifies your company’s spending process.

By integrating your company credit cards with Bezala, we seamlessly link your cards to your accounting software. We combine expertise in credit cards and accounting to simplify expense claims — helping you streamline workflows and stay in control.

In Bezala, you can see an up-to-date and overall picture of missing receipts — no need to wait for the credit card bill to arrive.

We automatically link added receipts to credit card transactions. Therefore, there is no need for manual reconciliation in accounting.

Cardholders are reminded of missing receipts so you can forget about sending manual reminders.

Exchange rates are automatically retrieved from credit card companies based on the actual exchange rate used at the time of purchase.

We integrate with most company card providers in Europe, and also support uploading credit card files through the UI or through our real time API.

AirPlus is integrated to Bezala with daily transaction files. We support AirPlus in all countries.

First Card is integrated to Bezala with daily transaction files. We support First Card in all countries.

Danske Bank Mastercard is integrated to Bezala with daily transaction files.

Pliant is integrated in real time, supported in all countries where Pliant can issue cards.

Ask an employee if they want a company card and most will say yes. Ask the finance team if they want to give company cards to all, and the answer will most likely be no. The main issue is employees using corporate cards and then forgetting to submit receipts. Some companies chose to “use a stick” through a 30-day-rule where if the expense isn’t filed it will be deducted from the salary. Others close their eyes to the huge amount of missing receipts in the settlement account and hope that the auditors won’t notice it. But both of these options can be harmful to your culture, thus we recommend to have a policy before ordering corporate cards.

| Type of policy | How the policy is supported in Bezala |

| Strict policy | No one get’s a card. Employees have to pay with their own cash and will get reimbursed later. We support this policy by ensuring quick reimbursements. When approved, expenses can be reimbursed within a day. |

| The lucky few policy | Only a few people get corporate cards (paid for by the company), and the company strives to have most purchases be paid for with those cards. We make submitting card receipts as easy as possible, and if needed allow others to submit receipts on the card users behalf. |

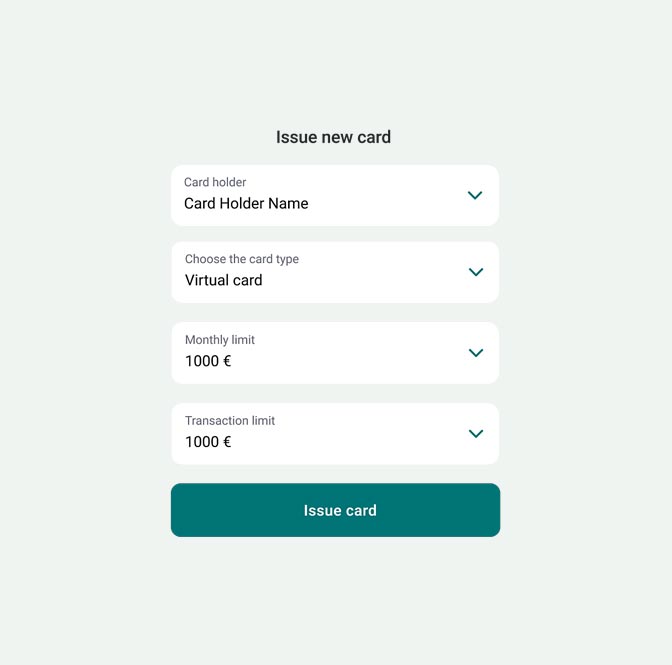

| 100% trust policy | All employees that ask get a company card. We can allow your employees to request for a Bezala virtual card from the mobile app. |

| The optimal combination | We recommend that those employees that have at least one expense per month should get a company-paid corporate card. But that corporate card should have a time-limit for submitting receipts, after which the non-submitted receipts are billed from the employee or deducted from their salary. This allows for the company to give credit cards to those who need them, and to automate their accounting whilst making sure that all receipts are submitted. We can support this model by auto-deducting missing receipts from the employees salary. |

There are three main types of receipts. Here are our tips on how to automate these expenses using Bezala:

| Type of receipt | How to automate |

| 41,1% of receipts have a VAT% and a local currency (can be deducted) | These are most likely domestic receipts which can be deducted. These vendor might have an agreement with an e-receipt provider –> Bezala will fetch the receipt from there. |

| 12% of physical receipts are in another currency. | Bezala will read the receipt when it’s photographed, and fill in the Price, Currency and date automatically. When the proper currency conversion rate is received from the credit card company, bezala updates the receipt to have the same exchange rate as the actual transaction. Furthermore, these receipts can also be sent to a cash-back company that will try to get back the VAT from the foreign government. |

| 14,5% of receipts are sent to us via email. | Bezala is exceptionally good at automating e-mail receipts. All you need to do is to forward the email to Bezala, and a receipt will be created based on the email body and attachments. In most cases, the price and date are automatically read, and the e-mail receipt is connected to the proper credit card transaction.

Got subscriptions? Bezalas subscription automation helps by copying the image from the last existing receipt of that subscription. IF the subscription is setup and the approval is automated, this flow will be 100% automated, requiring no human action. (Exception: Domestic subscriptions require the user to insert a receipt) |

Get in touch, and we’ll discuss your organization’s needs and explore together how Bezala could help – or download a brochure to learn more at your own pace first.

Need help? Don’t hesitate to reach out—our team is here for you! Open Monday-Friday 9 am to 3 pm (Helsinki time zone).

Help center