Travel expenses in Germany

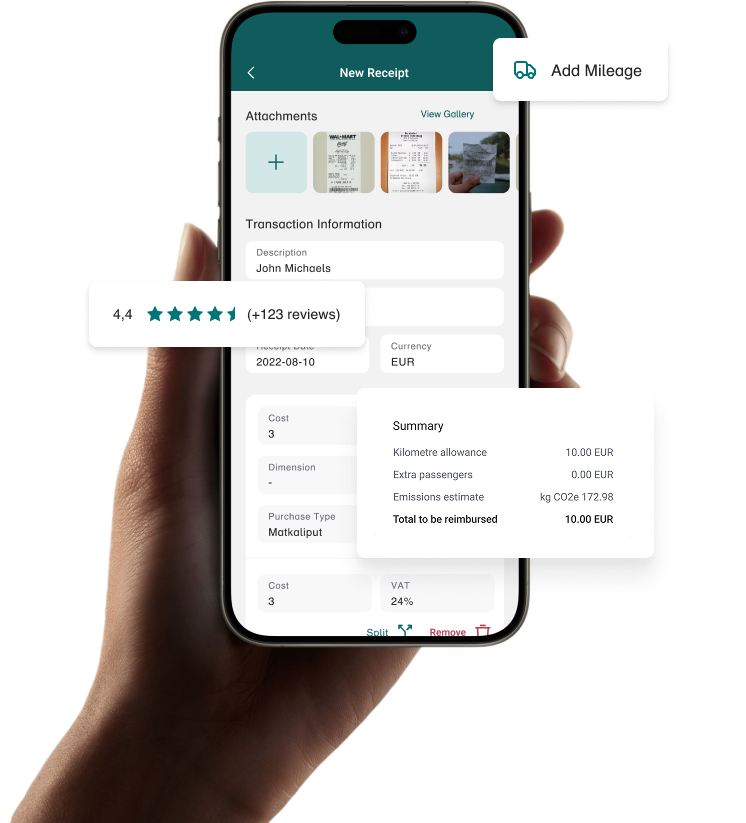

The Bezala travel expense app allows you to apply for local per diems and mileage allowances defined by the German Tax Office.

The Bezala travel expense app allows you to apply for local per diems and mileage allowances defined by the German Tax Office.

| Currency | Euro € |

| VAT | 19%, 7% |

| Mileage allowance | 0.30/km |

| Per Diem | 28 € |

Bezala supports VAT rates, expenses claims, mileage allowances, and per diems in Germany.

When driving by own car or other motor vehicles (KFZ), the rate for tax-exempt Mileage allowance is 0.30 € / km. For motorcycles, scooters, and mopeds, the allowance is 0.20 € / km. Bezala makes claiming German mileage allowances easy.

The accommodation allowance is 20 € per night if the employer does not provide the accommodation for the employee.

You can claim local and foreign Per Diems defined German Tax Administration with Bezala.

Deductions from Per Diems

If the employer offers free meals to the employee during the travel, the meals should be deducted from the Per Diem paid to the employee.

Deductions:

However, free meals are not to be deducted from the partial per diem.

Bezala has an integration to USA based ERP system Netsuite.

In additional, you can create and modify csv files and we will send them directly to an SFTP server or e-mail. Check out our integrations.

Your team can easily file Receipts, Mileages and Per Diems and you can Approve them with one click. We’ll remind your employees of missing credit card receipts and automatically take care of your accounting.

Get in touch, and we’ll discuss your organization’s needs and explore together how Bezala could help – or download a brochure to learn more at your own pace first.

Need help? Don’t hesitate to reach out—our team is here for you! Open Monday-Friday 9 am to 3 pm (Helsinki time zone).

Help center