Tax Reporting for Bezala Expenses

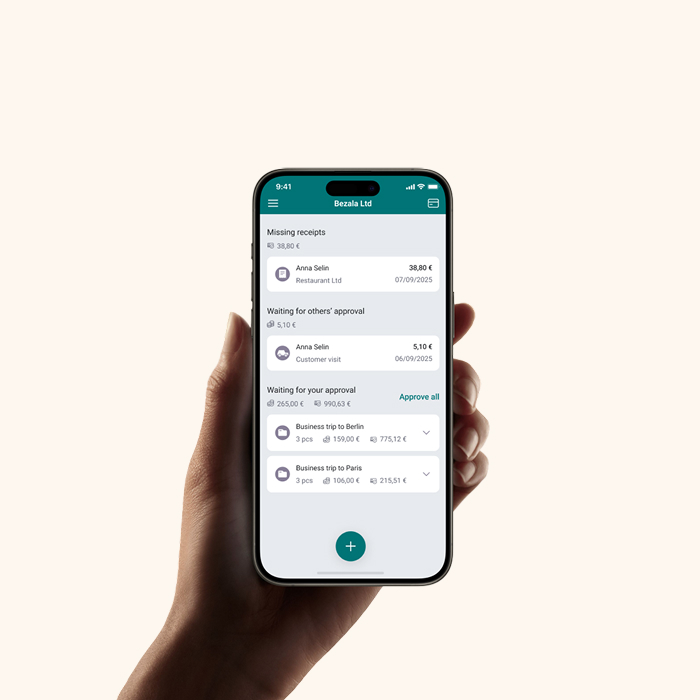

Tax reporting requirements vary by country, but Bezala helps you stay compliant with ease.

Tax reporting requirements vary by country, but Bezala helps you stay compliant with ease.

In Finland, Bezala integrates directly with the Income Register, enabling automatic reporting of travel reimbursements, daily allowances, and other non-salary payments to Tax Authorities. This integration allows expenses to be processed through accounting instead of payroll, reducing manual work and improving accuracy.

In Sweden, Bezala supports reporting to Skatteverket, ensuring compliance and smooth data transfer.

For other countries or specific needs, reporting can be done manually through Bezala’s archive and export features.

We can also send data to payroll systems if needed.

Get in touch, and we’ll discuss your organization’s needs and explore together how Bezala could help – or download a brochure to learn more at your own pace first.

Need help? Don’t hesitate to reach out—our team is here for you! Open Monday-Friday 9 am to 3 pm (Helsinki time zone).

Help center