Bezala automates reminders of missing receipts and simplifies your company spending process by integrating with smart company cards and your accounting software. We know Credit Cards, we know accounting and want to help you improve your process.

The most common corporate cards already work with Bezala:

-

The Pliant card is integrated with Bezala in real time, meaning that you will be notified of new purchases as they happen.

Read more -

The Pliant card is integrated with Bezala in real time, meaning that you will be notified of new purchases as they happen.

Read more -

The Zevoy card is integrated with Bezala in real time, meaning that you will be notified of new purchases as they happen.

Read more -

Eurocard is the most popular Credit Card company for corporates in Northern Europe

Read more -

The Danske Bank Corporate Card is common among clients of Danske Bank.

Read more -

Nordea First Card is common among clients of Nordea.

Read more

Managing credit card receipts shouldn't be hard.

Supercharge your corporate credit card process with Bezala

Make no compromises: Get a full-on expense software that scales from 1 - 20 000+ employees and integrate it with the company card that suits you best. With Bezala + Credit Card you can:

- Follow all purchases, categorized with the right receipts

- Automate subscription receipts & e-receipts

- Set custom tags to match the accounting procedures

- Integrate and sync Bezala with your accounting system

There are four types of cards, select the correct one for you.

As the name indicates, this type of a card requires that you pay 100% of the bill every month. Therefore, the credit is time-limited.

Companies can chose who the bill is sent to: the company or the employee.

Pros: The employee can use this type of a card for personal expenses without involving the company.

Cons: The employee is responsible for the bill and thus carries most of the risk. If the employee cannot pay the bill during the collection process, the company guarantee will kick-in. However, if the company goes bankrupt, then the guarantor disappears, and the employee is responsible to pay the bill even though it consists of costs related to the company. Payroll insurance sometimes helps to recover the employees' losses, but not in all cases.

Credit line: typically 2000 - 10000€, 14-30 days

The banks business model: Interchange and reminder fees.

Onboarding time: 1-2 weeks

If the bill is sent to the employee: make sure that the expenses are reimbursed before the bill arrives, otherwise the employee has to temporarily fund the costs of the company.

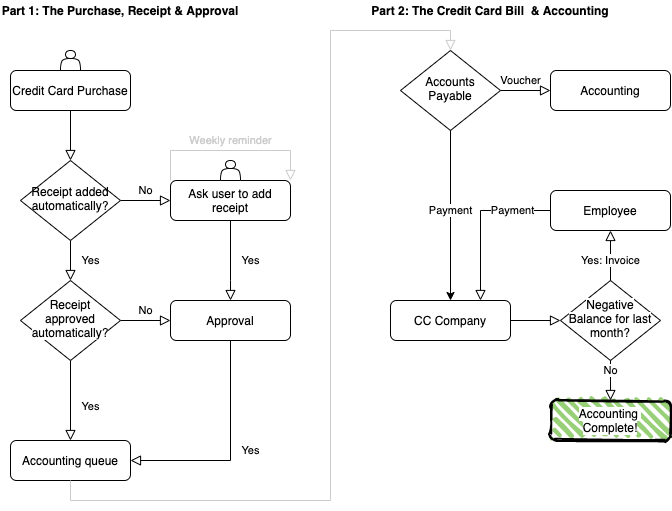

Credit Card Companies usually invoice on the first week of the month for the purchases made last month. This means that the time from purchase to invoice ranges from 1 to 5 weeks depending on when the purchase was made. But all credit card companies accept payments before they invoice, which means that your employees can have their credit card bill paid before it arrives if you get the receipt and approve and pay it within 1-5 weeks of the purchase.

With a Credit Card, the company gets a credit-line and can choose to deduct the bill with the minimum amount and pay interest on the outstanding credit line.

Pros: The employee doesn't have to pay for using the credit card and ultimately isn't responsible for how it's used

Cons: Motivating the employee to submit the expense claims can be hard, and this type of card often gives the biggest headache to the accountants.

Misuse can also be hard to deal with. Misuse of the card (ex. personal purchases) can be deducted from a current employees salary. But what happens if the employee has left the company? The employee might reimburse the misused funds if asked, but what if they refuse? A police report or legal actions can be taken, but the misused amount is too low to make an effort worth it in most cases. In most cases, the company writes down the misused funds as a loss in the profit and loss statement.

Credit line: 0-> unlimited, unlimited days

The banks business model: Interchange fees, interest fees and reminder fees: This is the most profitable card for the banks.

Onboarding time: 1-2 weeks

Prepaid cards require the company to top-up the card before it can be used.

Pros: Easy to get, no previous company credit history required.

Cons: If the card balance doesn't cover the payment, the payment won't go through. This can be very harmful if critical systems rely on the card working.

Credit line: -

The banks business model: Interchange and reminder fees.

Onboarding time: < 1 week

Most banks will give you debit card by default when you open a bank account.

Pros: These cards are super-easy to get.

Cons: These cards create a lot of unwanted manual tasks for the accountants.

Credit line: -

The banks business model: Interchange fees.

Onboarding time: < 1 week

Who should get a company card? That depends on your culture and policy.

Ask an employee if they want a company card and most will say yes. Ask the finance team if they want to give company cards to all, and the answer will most likely be no. The main issue is employees using corporate cards and then forgetting to submit receipts. Some companies chose to "use a stick" through a 30-day-rule where if the expense isn't filed it will be deducted from the salary. Others close their eyes to the huge amount of missing receipts in the settlement account and hope that the auditors won't notice it. But both of these options can be harmful to your culture, thus we recommend to have a policy before ordering corporate cards.

- Strict policy: no one get's a card. Employees have to pay with their own cash and will get reimbursed later.

- The lucky few policy: Only a few people get corporate cards (paid for by the company), and the company strives to have most purchases be paid for with those cards.

- 100% trust policy: all employees that ask get a company card

- The optimal combination: We recommend that those employees that have at least one expense per month should get a company-paid corporate card. But that corporate card should have a time-limit for submitting receipts, after which the non-submitted receipts are billed from the employee. This allows for the company to give credit cards to those who need them, and to automate their accounting whilst making sure that all receipts are submitted.

When you have corporate cards: use Bezala to automate the receipts.

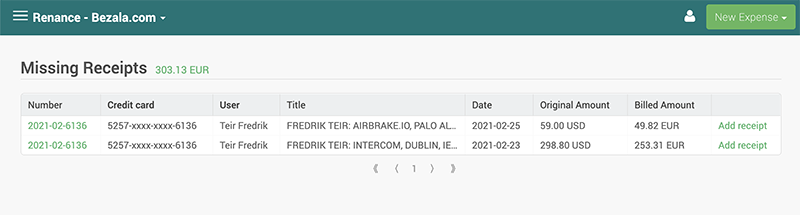

We had a look at the expenses submitted to Bezala in February 2021, and found three main types of receipts. Here are our tips on how to automate these expenses using Bezala:

| Type of receipt | How to automate |

|---|---|

| 41,1% of receipts have a VAT% and a local currency (can be deducted) | These are most likely domestic receipts which can be deducted. These vendor might have an agreement with an e-receipt provider --> Bezala will fetch the receipt from there. |

| 12% of physical receipts are in another currency. | Bezala will read the receipt when it's photographed, and fill in the Price, Currency and date automatically. When the proper currency conversion rate is reived from the credit card company, bezala updates the receipt to have the same exchange rate as the actual transaction. Furthermore, these receipts can also be sent to a cash-back company that will try to get back the VAT from the foreign government. |

| 14,5% of receipts are sent to us via email. | Bezala is exceptionally good at automating e-mail receipts. All you need to do is to forward the email to Bezala, and a receipt will be created based on the email body and attachments. In most cases, the price and date are automatically read, and the e-mail receipt is connected to the proper credit card transaction. Got subscriptions? Bezalas subscription automation helps by copying the image from the last existing receipt of that subscription. IF the subscription is setup and the approval is automated, this flow will be 100% automated, requiring no human action. (Exception: Domestic subscriptions require the user to insert a receipt) |

Use Bezala to streamline the Accounting Process.

Accountants have to be able to explain how every single penny has been used, and why. Most companies need to report their Profit and Loss statement every month during the first two weeks. In other words, the receipts have to be in accounting within two weeks from the month-end.

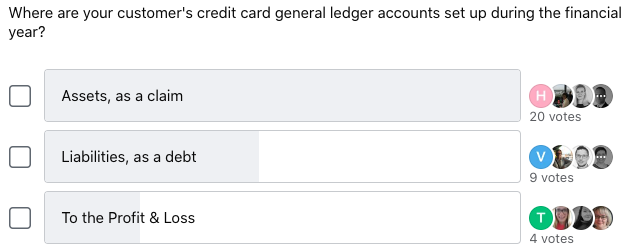

We asked 32 accountants how they handle credit card receipts, and over 75% save the bill to the balance sheet.

Some companies just attach the receipts to the Credit Card Bill (=Purchase Invoice) when it comes to the Bills Payables. This works only IF all of the receipts are delivered on time, and requires that you manually enter the expense account and cost centers for each row. Therefore, it's uncommon that this method works in the long run.

Why choose this method?

- No reconciliation needed

A company balance sheet shows what assets and loans the company has at any given time. The Profit and Loss statement shows how the company performed for any given time. The accountants use the balance sheet to check if there is something missing from the profit and loss statement.

- Ex 1:

Credit Card (CC) transaction bill has arrived, corresponding receipt is accounted--> The accounting will be perfectly balanced, and the cost will show in the profit & loss statement - Ex 2:

CC transaction bill has arrived, receipt not accounted--> The accounting will have an outstanding in the balance sheet, nothing in the profit & loss statement yet (P&L is wrong) - Ex 3:

CC transaction bill has not arrived, receipt is in accounting--> The balance sheet will be off (BS is wrong), the profit statement will be correct

The reconciliation formula

Accountants can calculate the Balance of credit cards in the Balance sheet by reconciling. The formula is:

+ Billed, not in accounting

- Missing receipts X€

- Billed, Connected but not accounted X€

- Not billed, accounted

- Accounted, Connected but not billed Y€

- Accounted, not Connected and not Billed Y€

= The Balance of the credit card asset account

The common reconciliation methods

As you can imagine, reconciling is quite burdensome and often the least productive task in the monthly accounting process. Some accounting softwares have developed reconciliation tools to help the accountant do this, but they are far from automated, requiring lots of manual clicking and combining receipts with credit card transactions.

But for most accountants, this is done manually with Microsoft Excel. Lovely.

We recommend that you book the credit card bill to the balance sheet as a claim, and allow us to book the receipts directly to the Profit and Loss statement. And to make your accountants life easier, you can always log in to Bezala to see what receipts are missing, which equals the outstanding in the Balance Sheet. In other words: no manual reconciliation needed!

Use Bezala with your current Accounting Software

Accounting credit card transactions doesn't have to be hard. We've integrated with most accounting and HR software to make it a lot easier.

Trusted by 2000+ companies:

From corporates to sport-associations, Bezalas credit card solution works for all different sizes and industries.

To summarise: Use bezala with your corporate cards to:

Get those receipts on time

- Notifications when the card is used

- Easily capture and match receipts

- Automatic categorisation of all purchases

See where the company money is going

- Follow all purchases, categorized with the right receipts

- Set custom tags to match the accounting procedures

- Integrate and sync Bezala with your accounting system