Travel expenses in Denmark

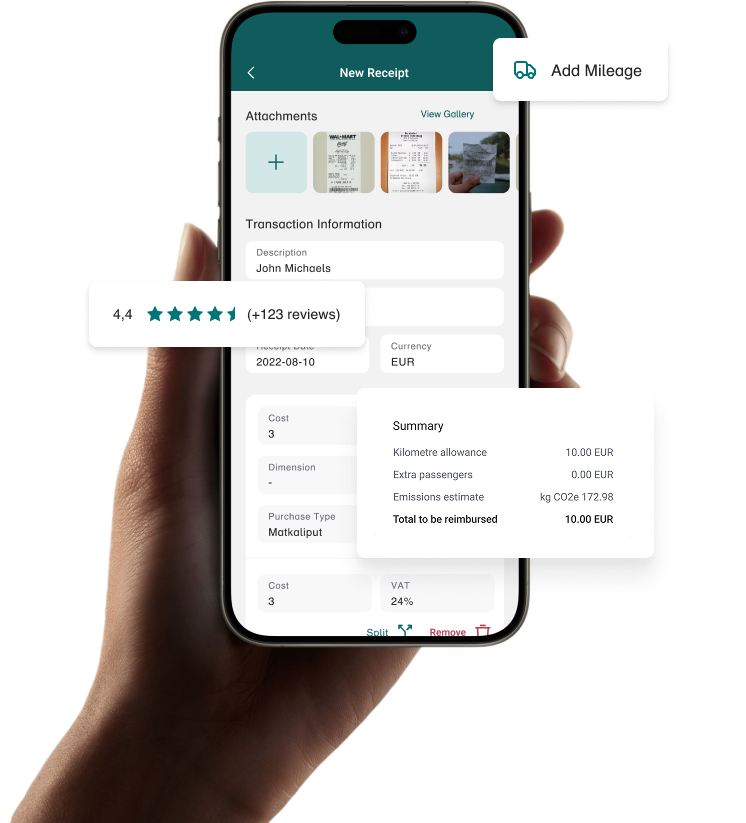

The Bezala travel expense app allows you to apply for local per diems and mileage allowances defined by the Danish Tax Agency.

The Bezala travel expense app allows you to apply for local per diems and mileage allowances defined by the Danish Tax Agency.

| Currency | Danish krone DKK |

| VAT | 25% |

| Mileage allowance | DKK 3.81/km |

| Per Diem | DKK 256 (accommodation), DKK 597 (food and other) |

In Denmark, Bezala supports VAT rates, expense reimbursements, mileage allowances, and per diems.

When driving your own car for business use, the basic tax-free mileage allowance is DKK 3,81 / km when other travel costs are not reimbursed. Bezala fully supports mileage allowances in Denmark.

Accommodation: DKK 256

The Danish Daily allowance consists of accommodation compensation, as well as compensation for food and petty acquisitions. No daily allowance is paid for trips lasting less than 24 hours, but the actual costs can be compensated by reimbursements or by providing the employee with free meals. The employer must check the purpose of the business trip, the travel dates, the amount of the travel allowance and other important information about the business trip, so that the allowance can be paid tax-free. Bezala is a great solution for purpose like that. Compensation can be paid to an employee working in the same temporary workplace for a maximum of 12 months.

The definition of a business trip is that the employee has a temporary job, a normal place of residence, and spends the night away from home. The distance and the nature of the work tasks determine whether the trip is considered a business trip. The assessment of the need for accommodation is always individual, but the general requirement is that the employee spends the night at home whenever possible. Difficulty, long distance, impracticality or the fact that traveling is expensive are not sufficient reasons not to spend the night at home.

The accommodation allowance covers all undocumented accommodation costs related to travel, but it cannot be paid if the employee has received accommodation even partially free of charge. The compensation is tax-free if it does not exceed the given maximum compensation amount. If the accommodation costs are higher than the compensation that can be paid, the actual costs can be compensated with expense reimbursements. Accommodation compensation is only available when the travel time exceeds 24 hours.

Food and petty acquisitions: DKK 597

Food costs are also part of the daily allowance. The compensation is intended to cover all undocumented meal expenses and other incidental expenses caused by business travel. Food compensation can be paid per day, so the work trip must last more than 24 hours for the employee to be entitled to daily allowance. It is also paid for every hour of travel started after the first 24 hours, so for example, for a 40-hour trip, the compensation is the daily allowance plus 16/24 parts of the daily allowance.

Deduction for meals:

Your team can easily file Receipts, Mileages and Per Diems and you can Approve them with one click. We’ll remind your employees of missing credit card receipts and automatically take care of your accounting.

Get in touch, and we’ll discuss your organization’s needs and explore together how Bezala could help – or download a brochure to learn more at your own pace first.

Need help? Don’t hesitate to reach out—our team is here for you! Open Monday-Friday 9 am to 3 pm (Helsinki time zone).

Help center