Travel expenses in United States

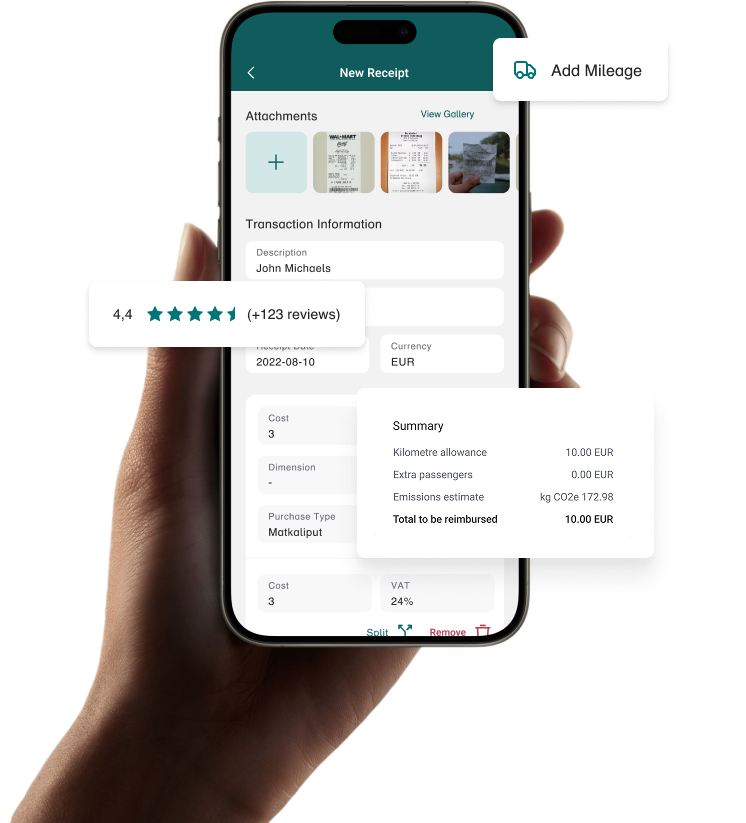

The Bezala travel expense app allows you to apply for expense claims and mileage allowances defined by IRS.

The Bezala travel expense app allows you to apply for expense claims and mileage allowances defined by IRS.

| Currency | United States dollar, USD, $ |

| VAT | No nation wide VAT %, they are state specific |

| Mileage allowance | $ 0.70/mile |

| Per Diem | Vary by county and season, not required by law |

In the United States, companies can decide their own reimbursement amounts for travel expenses.

The US tax administration (IRS) also determines the compensation amounts annually, which also act as the maximum amount for tax-free compensation. However, the most common way to compensate the expenses is reimbursement based on actual expenses.

Bezala works in the US for both expense reimbursements and mileage rates (IRS).

When driving your own car, the tax-free mileage rate (Mileage Rate) determined by the IRS is 0.70 $/mile.

You can apply mileage allowances defined by the IRS in Bezala.

The most common way to compensate the expenses incurred during business trips is to compensate them according to the actual expenses with expense reimbursements.

However, companies may choose to pay per diems according to amounts predetermined by either the federal government (General Services Administration – GSA) or the Internal Revenue Service (IRS). Daily allowance amounts vary by county and season.

In Bezala, you cannot apply for per diems defined by the GSA or the IRS.

Internal Revenue Services: IRS mileage rates for 2025

Bezala has an integration to USA based ERP system Netsuite. In additional, you can create and modify csv files and we will send them directly to an SFTP server or e-mail. Check out our integrations.

Your team can easily file Receipts, Mileages and Per Diems and you can Approve them with one click. We’ll remind your employees of missing credit card receipts and automatically take care of your accounting.

Get in touch, and we’ll discuss your organization’s needs and explore together how Bezala could help – or download a brochure to learn more at your own pace first.

Need help? Don’t hesitate to reach out—our team is here for you! Open Monday-Friday 9 am to 3 pm (Helsinki time zone).

Help center