Travel expenses in Norway

Do you have business in Norway? Bezala supports VAT rates, mileage allowances, and travel reimbursements in Norway.

Do you have business in Norway? Bezala supports VAT rates, mileage allowances, and travel reimbursements in Norway.

| Currency | Norwegian krone NOK |

| VAT | 25%, 12%, 15% |

| Mileage allowance | NOK 3.5/km |

| Per Diem | NOK 384, 713 or 977 depending on length and whether accommodation is included |

Tax free amounts:

There may also be some additions to the allowances:

Companies can also choose to pay employees government car allowance. This rate is NOK 4.48 / km. In practice, the difference between these two mileage allowance rates is that the employee pays tax on the last NOK 0.98 / km of the government car allowance.

In Bezala there is two ways to handle government car allowance:

1) Mileage allowance can be set to NOK 3.50 / km, and the company must take care of the tax on the NOK 0.98 / km in accounting. (Default method)

2) Mileage allowance cab be set to NOK 4.9 / km, and the company manually reports 1.40 / km to Tax administration.

Per diems for travel without accommodation:

Per diems for travel with accommodation:

The per diem is tax-exempt if the allowance does not exceed the given values. If the reimbursement exceeds the given rates, the excess becomes taxable. The amount of per diem depends on the duration of the trip and where the employee is staying.

An employee may receive per diem from travel that does not require staying overnight if the destination is more than 15 kilometers from the employee’s home and the commute takes at least 6 hours. An employee must spend at least five hours of the night away from home to be eligible for the per diem rates with accommodation. The night on this occasion is between 10 pm, and 06 am. If the travel continues for more than 6 hours the day after the accommodation, the employee is entitled to a full per diem.

Deductions from Per Diems

If an employee is compensated for a meal or meals by the employer, customer, or event organizer, the meal allowances should be deducted from the per diem paid. The deduction is stated in percentages, and the final deduction is rounded to the nearest whole crown.

The amounts mentioned above come from the national special agreement (særavtale) SGS 1001 Reiseregulativet (01.01.2025–31.12.2026), which was concluded between KS (Kommunesektorens organisasjon) and municipal sector employee organizations. In Norway, companies are free to define their own travel expense policies, but many choose to follow the Statens reiseregulativ because its rates are clear and the amounts listed there are tax-free.

Special agreement (særavtale): SGS-1001-Reiseregulativet-01.01.2025-–-31.12.2026.pdf

Norwegian Tax Administration (per diem rates): Kost og losji – satser for trekk- og skattefri godtgjørelse – Skatteetaten

Norwegian Tax Administration (kilometer allowance): Bil – sats for skattefri godtgjørelse (kilometergodtgjørelse) – Skatteetaten

Bezala has an integration to USA based ERP system Netsuite.

In additional, you can create and modify csv files and we will send them directly to an SFTP server or e-mail. Check out our integrations.

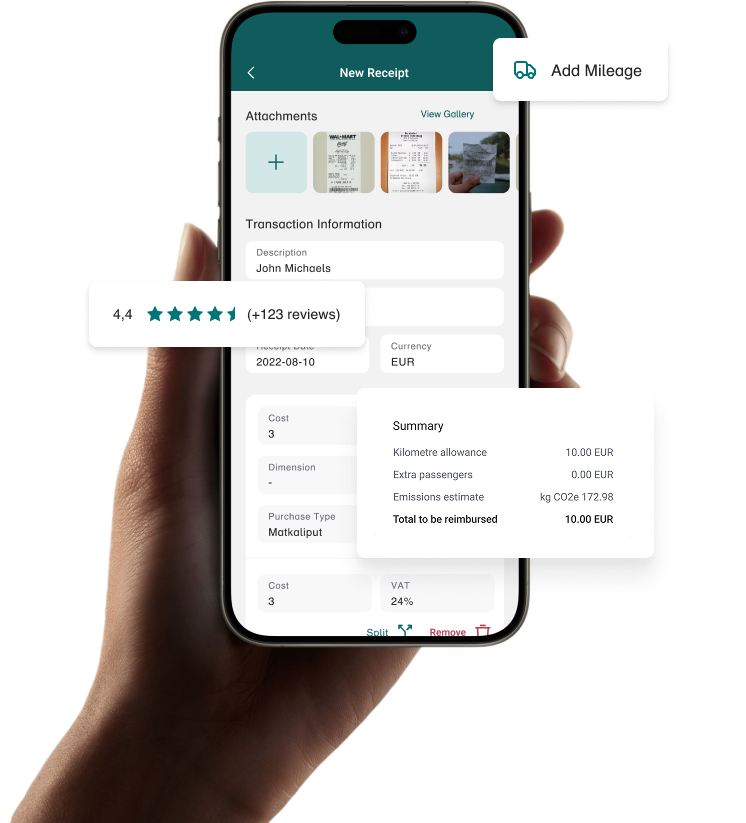

Your team can easily file Receipts, Mileages and Per Diems and you can Approve them with one click. We’ll remind your employees of missing credit card receipts and automatically take care of your accounting.

Get in touch, and we’ll discuss your organization’s needs and explore together how Bezala could help – or download a brochure to learn more at your own pace first.

Need help? Don’t hesitate to reach out—our team is here for you! Open Monday-Friday 9 am to 3 pm (Helsinki time zone).

Help center